michigan gas tax rate

For fuel purchased January 1 2017 and through December 31 2021. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

41 Credit Card Authorization Forms Templates Ready To Use In Credit Card Authorisation Form Template Aust Credit Card Pictures Credit Card Slip Card Template

Information on natural gas service and rates for business customers in Michigan.

. Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. 66 of gross cash market value. Michigan drivers were taxed 641 cents per gallon of gasoline in January 2022 the sixth-highest gas tax in the nation.

Diesel is 313 cents per gallon. That includes a roughly 1-cent automatic increase to the. Notice of Prepaid Sales Tax.

The Michigan gas tax is. What is Michigans gas tax now. These taxes levied under the authority of the Motor Fuel Tax Act 2000.

Michigan natural gas rates. Gas Natural Gas Liquids Condensate. 56 rows Gasoline is 273 cents per gallon.

This charge varies with the amount of gas you use each month. Customers with single-family homes pay 023990 per CCF for this service which includes an Energy Waste Reduction. Natural gas prices as filed with the Michigan Public Service.

In Michigan the median property tax rate is 1501 per 100000 of assessed home value. 263 cents per Michigan motor fuel tax. 2018 Millage Rates - A Complete List.

The Michigan Public Service Commission approves. 120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents. Diesel Fuel 263 per.

2021 Millage Rates - A Complete List. The number of gallons at the pump increases so does the. This is what MGU pays for the gas we do not mark up or profit from the price of gas.

Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground. You pay 077082 per CCF for the gas you use. Michigan Gas Choice allows you to choose your natural gas.

Michigan Motor Fuel Taxes. If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in. 7521 Westshire Drive Suite 200.

2020 Millage Rates - A Complete List. 2019 Millage Rates - A Complete List. It will remain in place until at least the end of the year.

1 day agoThats because Michigan ties property taxes to inflation which was more than 6 when tax rates were set last November. Michigan levies a 19- cent-per-gallon tax on gasoline and a 15-cent-per-gallon tax on diesel motor fuel. This tax is effective per gallon every time you buy gas.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Many Lansing homeowners told News 10 theyre. Call center services are available from 800am to.

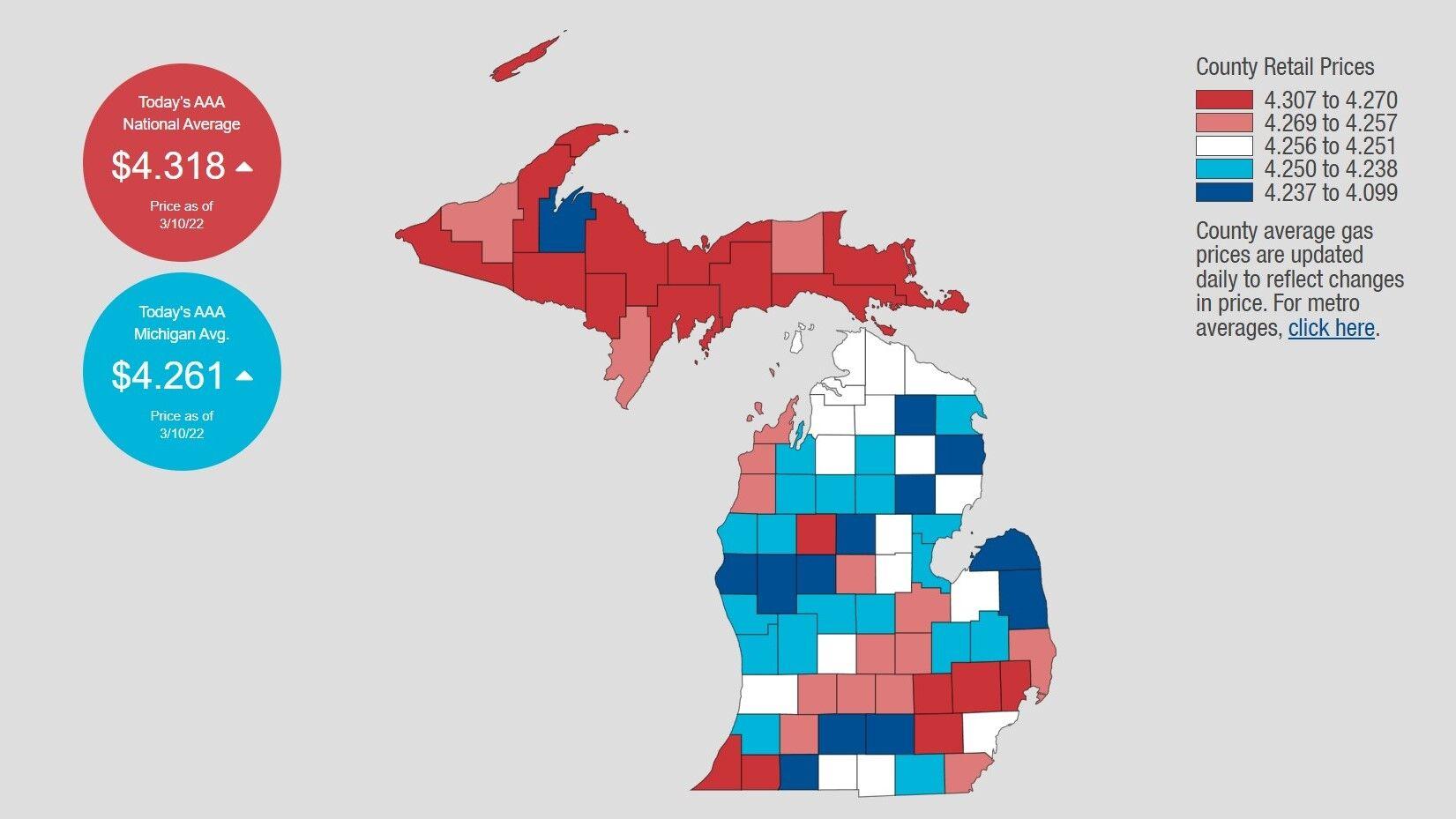

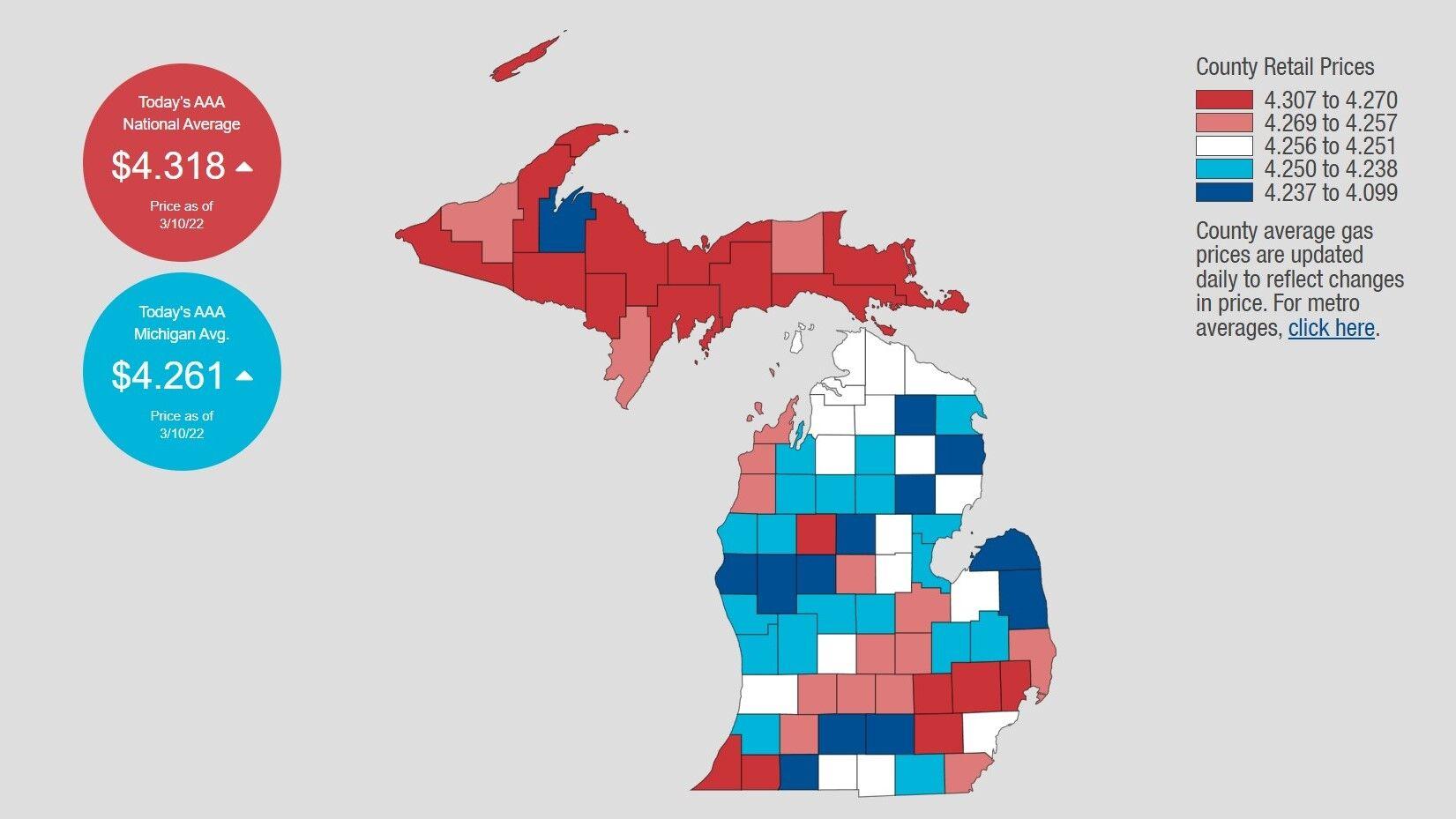

How does the Michigan gas tax work. Gasoline 263 per gallon. Gas Price Heat Map.

COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. Michigans excise tax on gasoline is ranked 17 out of the 50 states.

Information on natural gas service and rates for residential customers in Michigan. Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Compressed Natural Gas CNG 0184 per gallon.

If a gallon of gas at the pump sells for 256 cents then 22 of the. Michigan natural gas rates. Michigan gas tax currently stands at 27 cents per gallon.

26 rows Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale. 4 of gross cash market value.

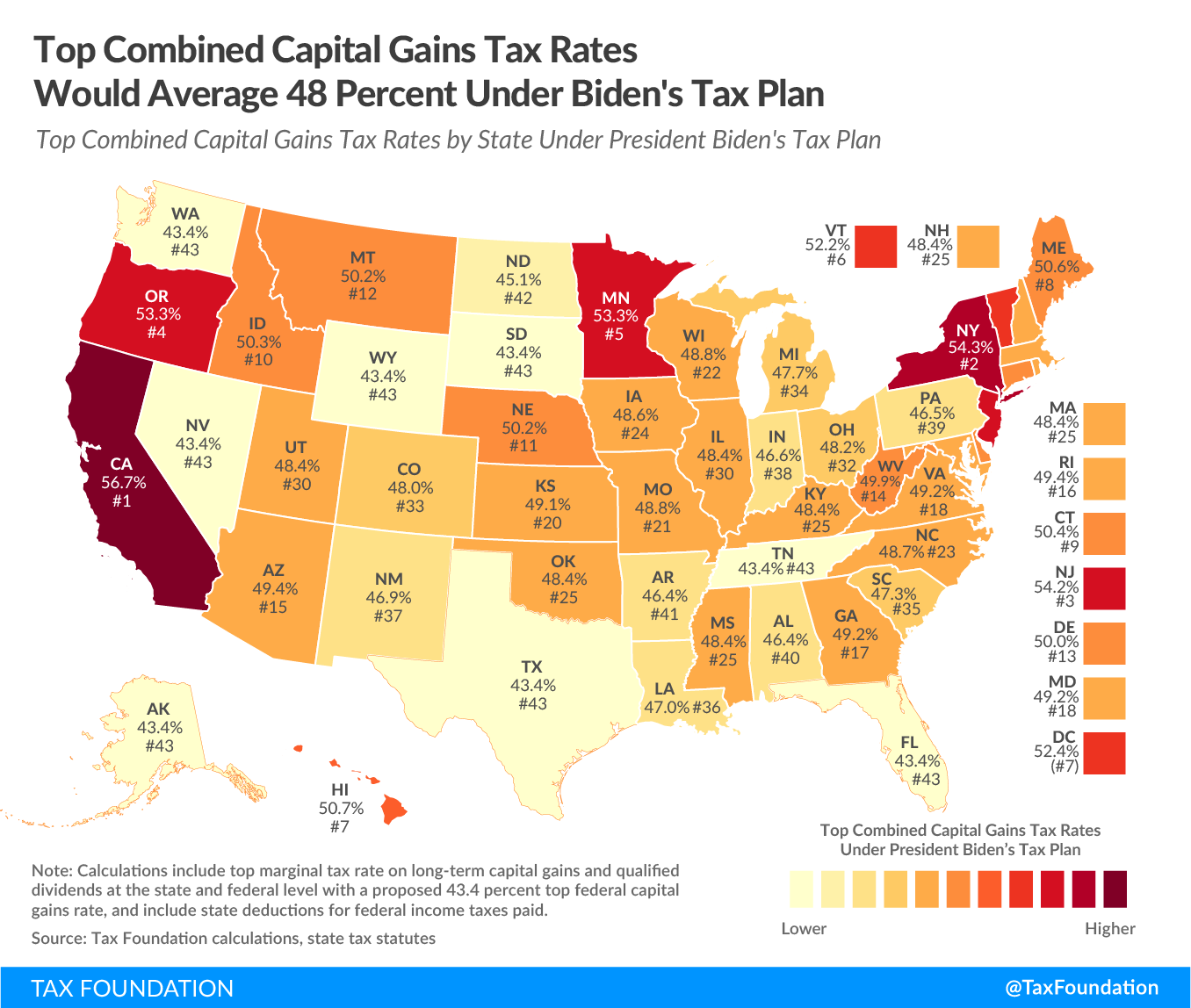

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

Pin By Eris Discordia On Economics Economic Analysis Advanced Economy Peer Pressure

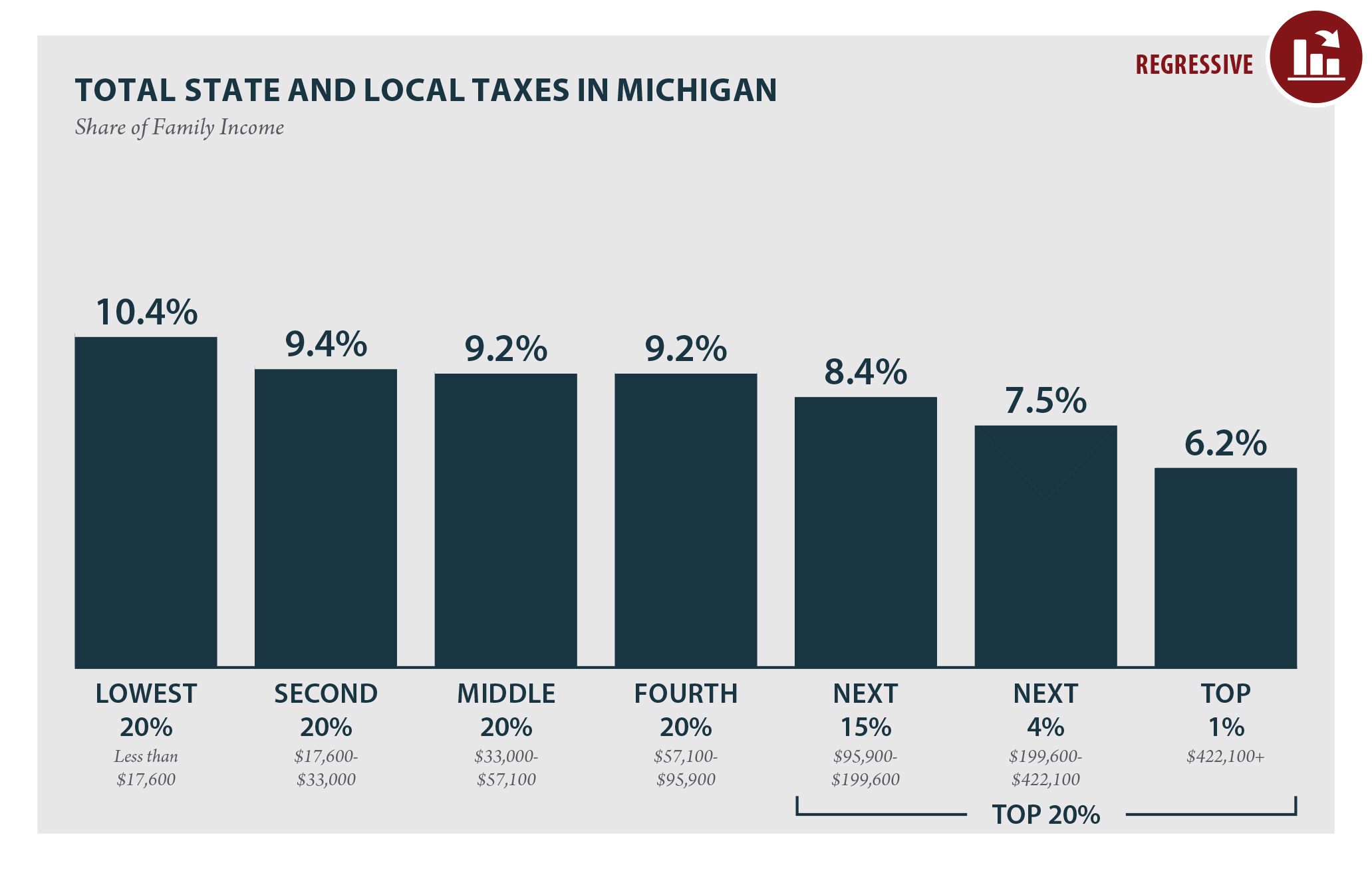

Michigan Who Pays 6th Edition Itep

Michigan Senate Passes Fuel Tax Pause Bills

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan Breaks Records For Highest Gasoline And Diesel Fuel Prices State Abc12 Com

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

1966 Chevrolet Impala S134 Indy 2020 Chevrolet Impala Impala Chevrolet

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Gas Tax Calculator Michigan Petroleum Association

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan

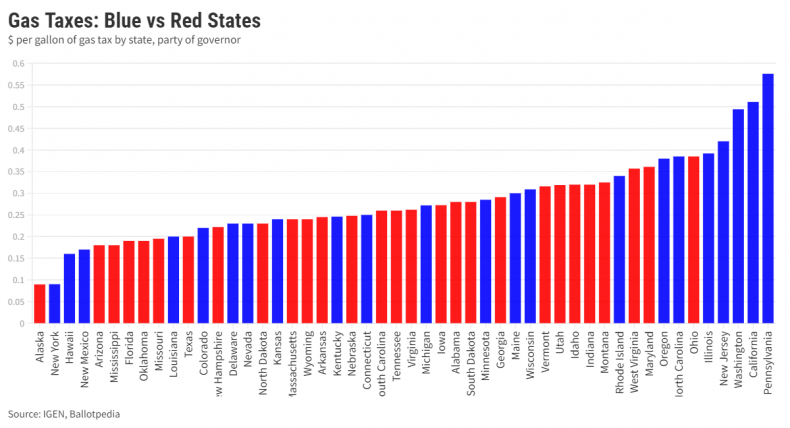

Gas Taxes Are Higher In Blue States Than Red Here S How And Why